tax effective strategies for high income earners

Pay Attention to the Medicare Surtax and Net Investment Income Tax for High Earners There are two types of Medicare tax that could be affected by your income level. With a DAF you can make a.

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO.

. Despite the increases of the standard deduction limits in recent years it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions. If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital gains. How much does a person have to pay as income tax.

For two unskilled workers this would half the cost of car ownership to about 18 of lifetime earnings Opel Corsa provided the overall distance driven does not increase. Thus the importance of tax-saving strategies for high-income earners is clear. Thats why its one of the most popular tax reduction strategies.

If you are a high-income earner it is sensible to implement tax minimisation strategies. One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of. Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation.

Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden. People with incomes from 209426 to 523600 fall in the 35. As of 2022 when this article was written if your income is above 140000 as a single filer or 214000 as a married filer sadly you are not allowed many of the tax breaks the majority of US citizens participate in.

Younger adults may find it effective to invest in a Roth IRA which uses after-tax dollars for a couple of reasons. This is one of the most basic tax strategies for high income earnersthat you can take advantage of. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions.

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

Tax reduction strategies for high-income earners in australia. As a refresher for 2021 FY the individual tax rates including medicare levy are. Effective tax planning with a qualified accountanttax specialist can help you to do that.

Family Income Splitting and Family Trusts. These penalties can range from fines to imprisonment for more. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. This can be effective if you have a high income now but anticipate potentially being in a lower tax bracket in retirement. The US has seven tax brackets 10 12 22 24 32 35 and 37.

This includes a variety of credits and deductions. How to reduce taxable income for high earners. Tax Strategies for High Earners.

Qualified Charitable Distributions QCD 4. Contribute to your Superannuation Fund. Not only had this concentrated stock position exposes the.

Re-examine Standard or Itemized Deductions. Creating an overall financial strategy that is both advantageous and tax-efficient can be daunting but doing so can help to ensure you maximize your hard-earned income and savings while minimizing taxes. When you invest in an RRSP the amount of your contribution is deducted from your taxable income thereby reducing your tax bill.

A donor-advised fund DAF is an investment account created to support charitable organizations. 10 Easy Ways To Save Income Tax In India Income Tax Ways To Save Tax High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan The 4 Tax Strategies For High Income Earners You Should Bookmark. So what are the top tax planning strategies for high income employees.

High-income earners like senior executives who accumulate a large concentrated stock from their employer. 6 Tax Strategies for High Net Worth Individuals. Maximising available allowances Careful consideration of the split of assets between spouses can have a significant beneficial impact on a couples income tax burden.

Pension planning Pensions continue to offer significant tax benefits that should not be ignored. These deductions are allowed even if you take a standard deduction and help you qualify for other credits on your return. For every dollar you earn youre giving up nearly half to the tax man.

Avoid concentrated stock positions. How to Reduce Taxable Income. For single filings income from 164926 to 209425 falls under brackets of 32.

In this post were breaking down five tax-savings strategies that can help you keep more money in your pocket. Tax deductions for high income earners 2019. For example you may be in a lower tax bracket now than you will be in retirement.

According to the ATO youre classified as a higher income earner if you earn over 180000 a year. It works by setting up a prescribed rate loan.

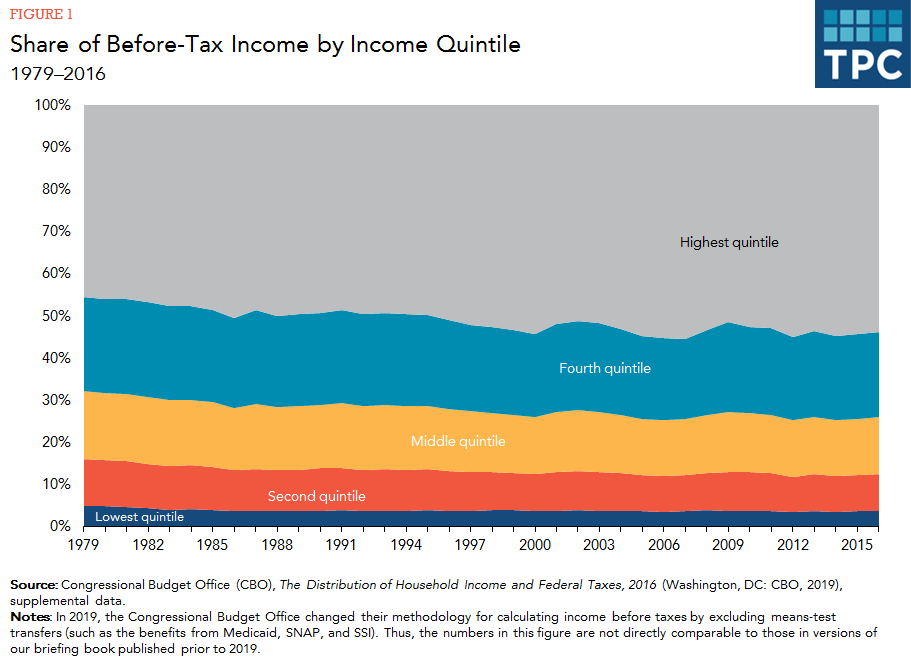

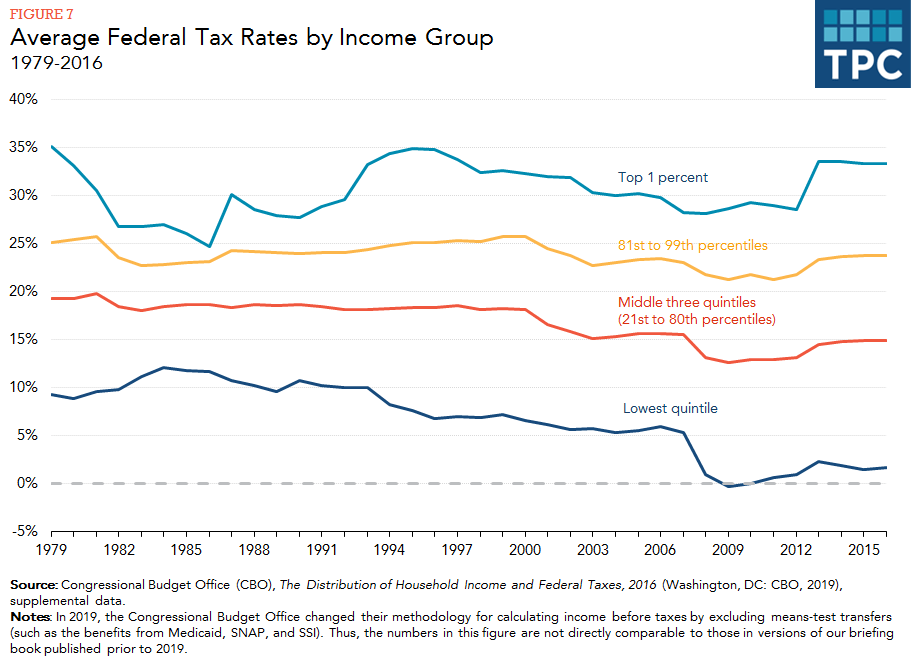

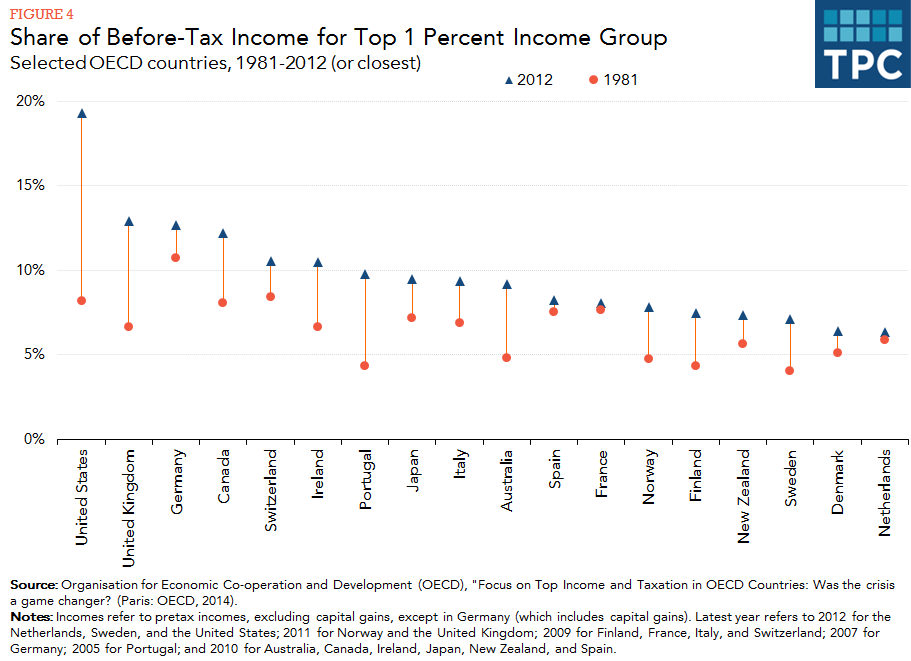

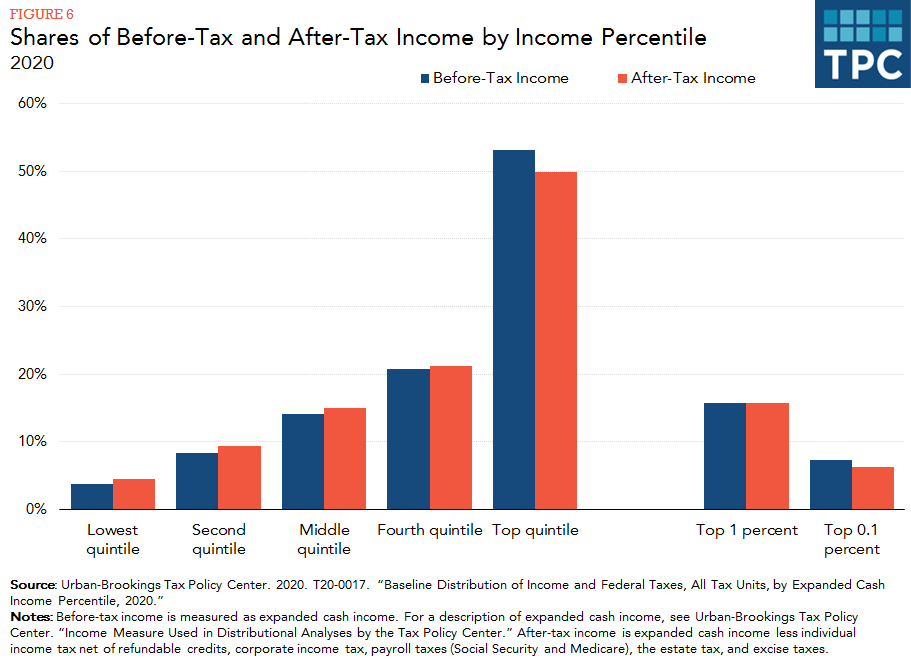

How Do Taxes Affect Income Inequality Tax Policy Center

How To Pay Less Tax In Canada 12 Little Known Tips

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiam Small Business Tax Business Tax Llc Taxes

Tax Strategies For High Income Earners Pillar Wealth Management

High Income Earners Need Specialized Advice Investment Executive

How Do Taxes Affect Income Inequality Tax Policy Center

Worthwhile Canadian Initiative The Impact Of Tax Cuts On Government Revenues

How Do Taxes Affect Income Inequality Tax Policy Center

How Fortune 500 Companies Avoid Paying Income Tax

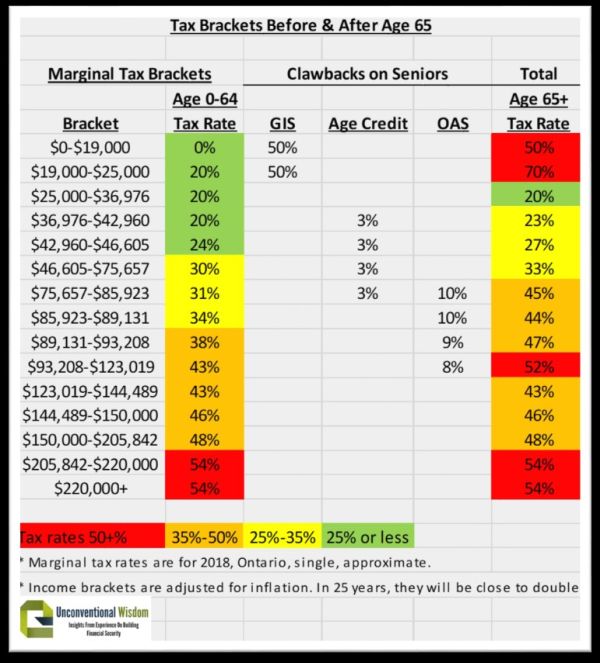

Personal Income Tax Brackets Ontario 2021 Md Tax

What To Invest In If I M In A High Tax Bracket Tax Efficient Investing Tax Brackets Investing Investing Strategy

How Do Taxes Affect Income Inequality Tax Policy Center

The Backdoor Roth Investing In A Roth Ira For High Earners Investing Money Investing Investing Strategy

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

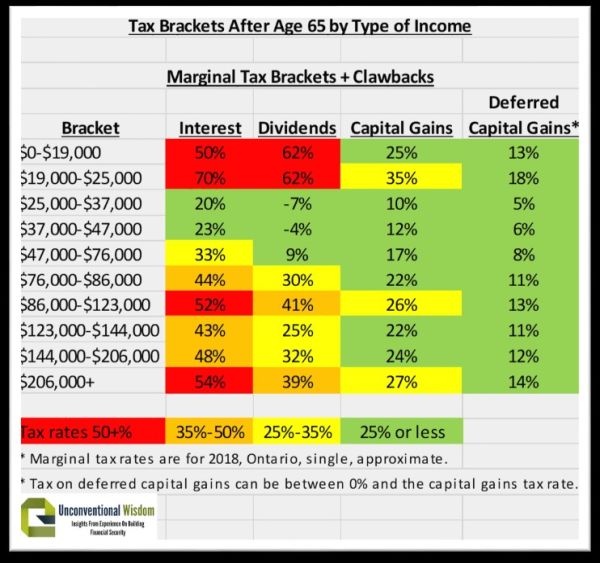

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy